Learn More

Special Report: Four global analysts from China, Brazil, US and Australia discuss trends of 2018 and beyond

Special Report provided to Ray White Rural Rockhampton from Simon Quilty – January 17, 2019

Simon Quilty is an independent meat and livestock analyst for MLX MPty Ltd and provides analytic assessments and reports on the beef industry/markets in general.

Four global analysts from China, Brazil, US and Australia discuss trends of 2018 and beyond

Last week I had a hookup with four other analysts from Brazil, Australia, US and China with the one purpose of trying to make sense of the trade wars, tariffs, global demand and supply and the potential ongoing impact of African Swine Fever and drought in Australia for 2019.

The following were some of the key points raised during our discussion

- Strong global beef export demand is expected by the 4 analysts present to remain firm in 2019 – with China, Japan and Korea all being key in keeping this momentum going – US exports today are close to 13.5% and this is expected to hold – though deep concerns exists about the impact of the trade war on global demand.

- Concern remain in the US on the expected record production of beef and pork in 2019 – as strong global demand keeps prices in the US buoyant – is this sustainable?

- Close to 20% of US steer values can be attributed to strong global beef exports – a stumble in global beef markets would see US steer prices fall abruptly.

- Brazil recently had 78 meat establishments approved for China comprising of 26 pork plants, 22 beef plants and 30 poultry plants.

- Russia’s recent decision to drop the 11 month ban on Brazilian beef and pork with 11 plants being automatically approved is expected to result in a ramping up of Brazil beef sales into Russia in mid 2019 it is expected that by 2020 shipments to Russia will be sizeable as more Brazilian plants become approved.

- Brazil’s truckers strike which impacted the country back in May this year saw the cost of transport rise within Brazil by more than 30% – with the largest impact being felt by grain producers – this strike is now being contested in court and could be overturned in 2019.

- China’s grey trade continues to be a huge headache for participants with an estimated 25,000 containers being held up in Vietnam or Hong Kong – with an estimated 8,000 containers of beef or close to 200,000 MT’s.

- Speculation exists that South Korea may have become the ‘new’ grey trade into China based on large South Korean pork import volumes and high South Korean domestic hog kills which are going somewhere – anecdotal evidence supports this theory.

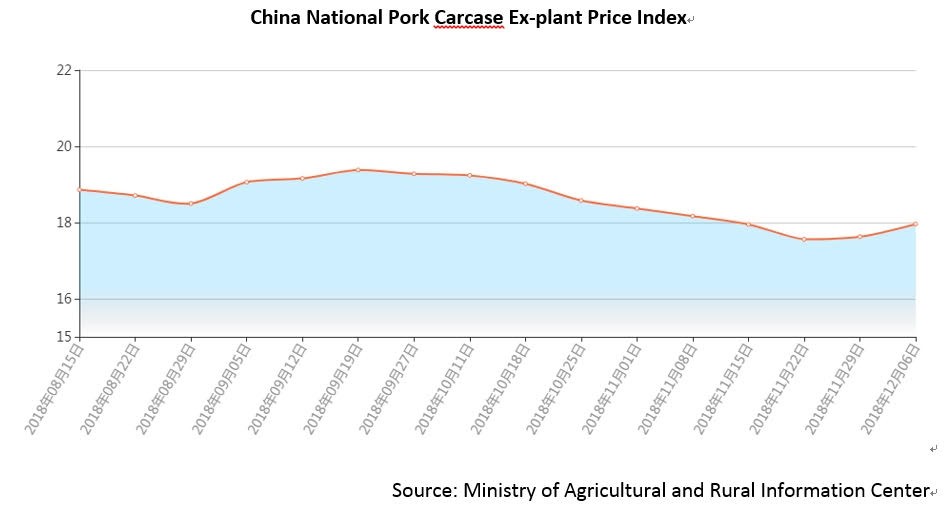

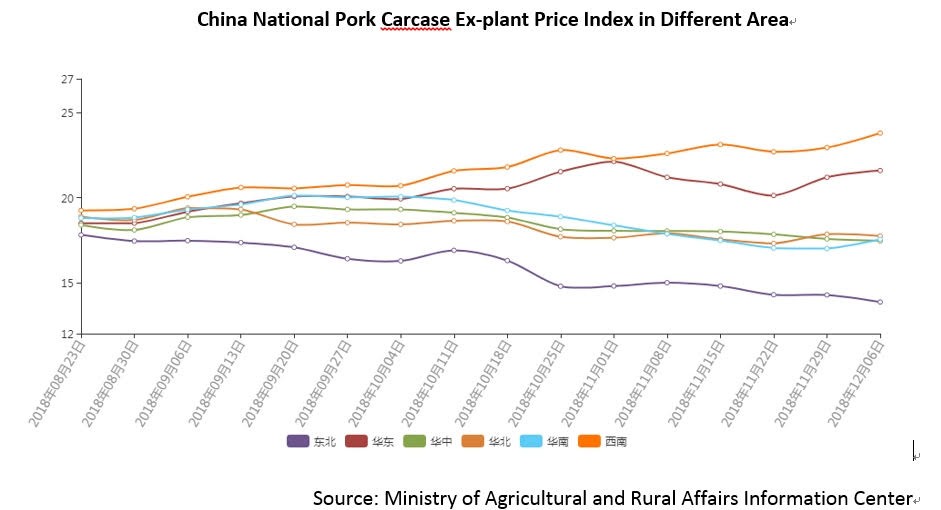

- The restriction on grey trade into China is causing a rise in China domestic pricing in the last 2-3 months of 0.5 RMB/kg nationally and in some regions 1.5-2 RMB/kg.

- There is more and more anecdotal evidence of backyard pig operations in China being removed as a means of containing African Swine Fever – in other words the culling process is significant

- The latest FAO report states 630,000 pigs have died in China from ASF occurring in 91 villages (this figure no longer includes culling numbers only disease deaths)

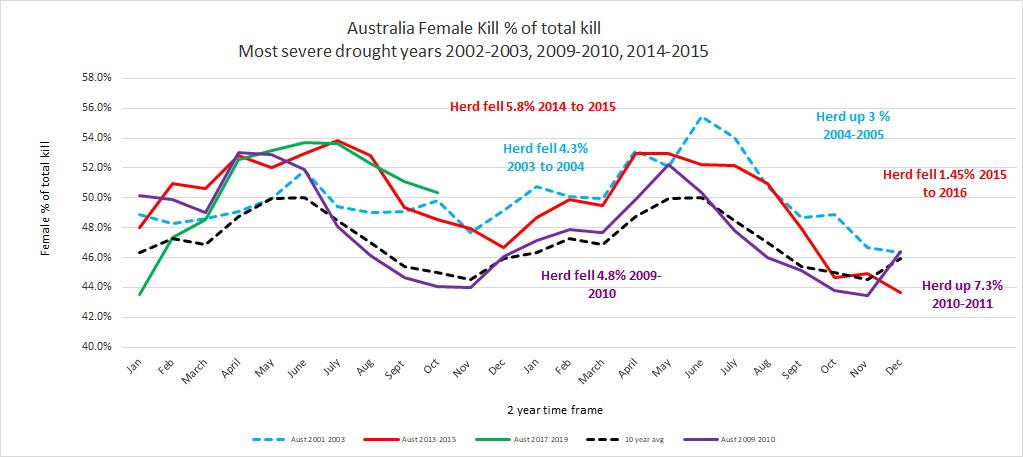

- Australia’s herd liquidation continues with the female kill still above 50% – the intensity of the drought has moved from the northern regions of Australia to the southern regions in recent months – September was the driest September Australia wide on record according to BOM.

- Back to back Australian cattle price cycles are expected and will gain momentum when the drought breaks – expectations are that by Q1 of 2021 Australian cattle cycles will have exceeded the highs of October 2016 (EYCI @ 725 ac/kg) and be above 800 ac/kg as stated should the drought break mid to late 2019.

Other points raised in the discussions:

- The US, Canada and Mexico have signed a new trade agreement that modernizes the North American Free Trade Agreement (NAFTA) – this still needs to be ratified by each country’s legislative bodies before it can take effect. It is now known as USMCA – US-Mexico-Canada Agreement.

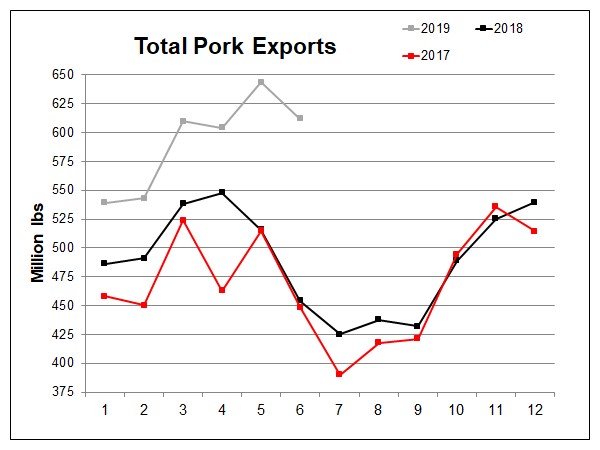

- China is buying U.S. pork again, with new interest possibly reflecting a sign the country’s African Swine Fever outbreak is causing concern about a future supply shortfall – two week’s ago USDA reported 3,348 tonnes of pork bought by China to be entered in 2018 and 9,384 tonnes to be shipped in 2019 which accounted for 72% of the total weekly sales to all countries – this is the largest pork order since the trade war began – and is potentially an indicator that China is about to ramp up pork purchasing from the US. It should be noted that an additional 2,100 tonnes was sold last week for 2018 entry.

- Argentina will soon sign a deal with the United States to allow bilateral trade of fresh beef for the first time in almost two decades – whereby 20,000 mt is the limit per annum into the US but interestingly there is no limit on US beef exports into Argentina.

1/ US analyst view – Global trade sentiment continues to be a roller coaster as US/China trade war continues

As markets were starting to gain hope on Monday last week President Trump tweeted that he was ‘Tariff Man’ and that he was not afraid to reimpose tariffs if China trade talks should fail after 90 days – as a result financial markets fell dramatically by 800 points or 3.1 %.

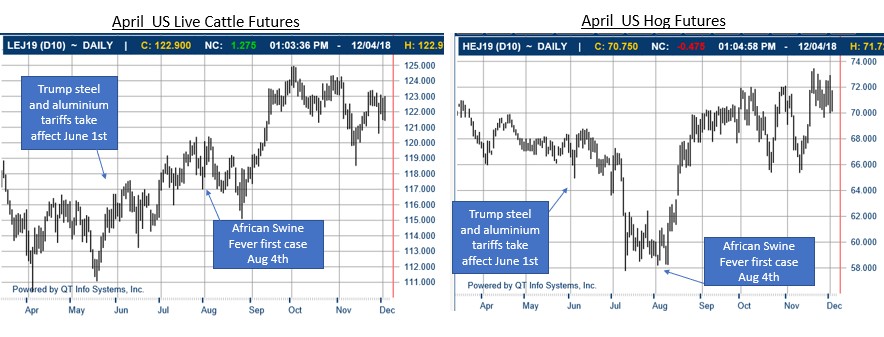

It was agreed that the pricing in today’s US cattle futures and US hog futures reflect to me the degree of uncertainty that exists globally – hog futures are higher namely due to African Swine Fever and cattle futures have in part been driven by strong global exports and good domestic demand – but given next year’s forecast increased US domestic cattle kill its unclear how sustainable this is.

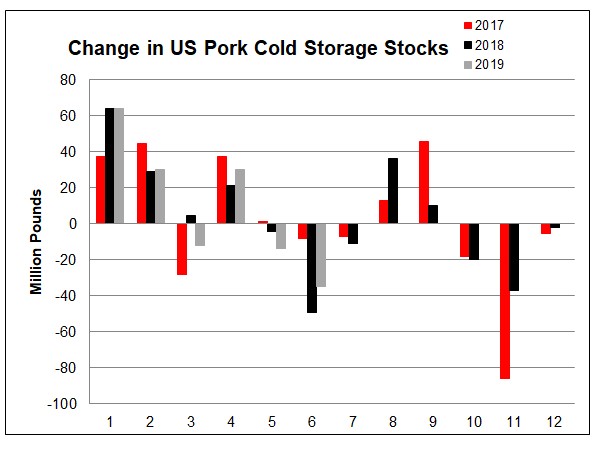

In the USDA most recent Economic Research Service (ERS) report it outlines expanding US pork production – due to strong domestic and international pork demand this has seen US pork inventories being kept current and even with record last quarter pork production the ending stocks-to-production ratio is projected to drop to its lowest level since 1990 – in other words, US domestic pork demand is outpacing US pork production – it is expected that U.S. consumers are likely to respond to lower prices in this last quarter by buying more pork at a time when real disposable personal incomes are going higher.

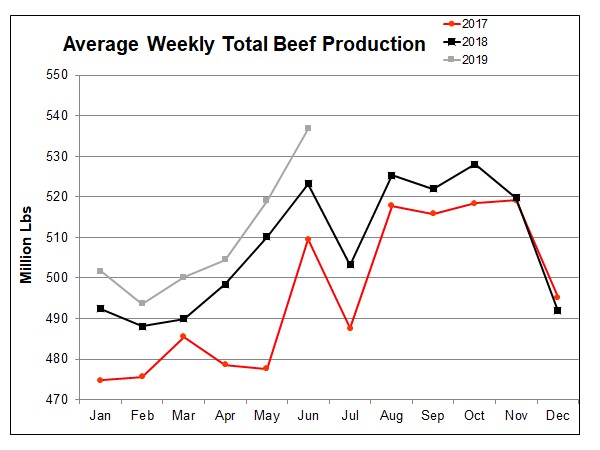

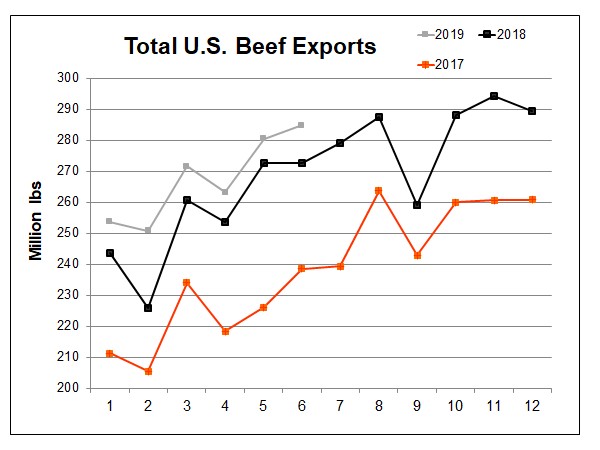

The USDA has reduced its production forecast for overall 2018 and 2019 beef production to 12.2 million tonnes and 12.6 million tonnes respectively – this is on the back of fewer than expected cattle placed in feedlots in Q3 of 2018 which in turn would see a lower turnoff in early 2019 for slaughter. Nonetheless record high beef production in 2019 seems inevitable and therefore demand both domestically as well as globally is critical to maintain beef and cattle prices in 2019 as record cattle supplies test the market and strong beef exports are critical. In the graphs below the strong US beef exports has been factored in to 2019 estimates at close to 4% higher than this year.

Key aspects influencing potential US domestic beef demand are:

- Pork production is expected to be higher which could dampen beef demand should pork prices weaken.

· Poultry production is likely to increase from record 2018 levels to new record production totals in 2019 – like pork could see lower pricing.

· Beef retail prices are at near record ratios compared to retail pork and poultry prices – how sustainable is this?

· Beef exports are up 13.3 percent year over year through September – this follows year-over-year annual increases of 11.8 percent in 2017 and 12.8 percent in 2016.

· Continued low beef imports are likely in 2019 in particular from Australia which is price supportive.

In the last week end users in the US have stepped up to start buying for Q1 & Q2 in relatively large volumes for next year as concern about beef availability has started to creep into the thought process and ongoing strong global beef demand still continues – many buyers have been hanging out for a break in US cattle prices but in reality this has yet to occur and is looking less and less likely – no one wants to be caught short in Q1 in a high demand market so this week buying is starting to occur in earnest.

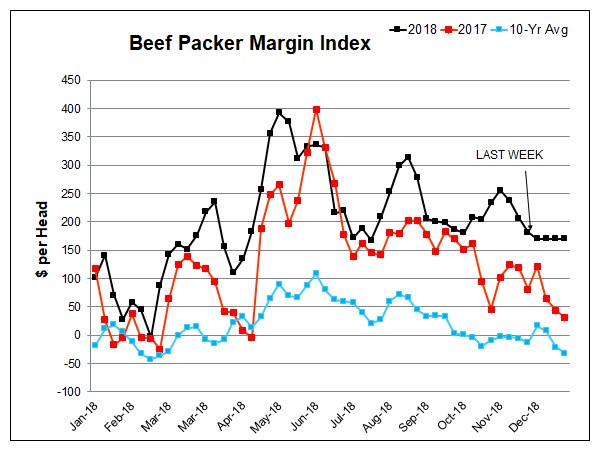

US beef packer margins remain positive – US Beef packer margins remain healthy with the index below highlighting 2018 as a very similar year for US beef packers as 2017 with margins reaching as high as $400 USD/head in May this year as both strong domestic and global demand and ample domestic supply has enabled packers to trade in a positive environment for almost the entire year with mid-February being the only month of break even. When assessing how important exports are to this bottom line its estimated that almost 20% of the margin can be attributed to exports even though only 13% of total production goes export – with good domestic beef supplies expected again next year and strong global and domestic demand 2019 is looking like another good year in US packer margins.

2/ Brazil analyst view – South American exports are likely to remain strong with more global demand expected due to Russia’s recent approval of Brazil.

Brazil – Russia on November 1st this year recommenced imports from Brazil for pork and beef from nine meat establishments – the import ban was introduced 11 months ago due to ractopamine, a feed additive being found in meat shipments. Only a few years ago Russia made up 40% of Brazil’s pork exports and in 2014 Brazil shipped 309,021 MT of beef which was close to $1.292 billion in sales, when you compare this years estimated Brazil exports to China of 330,000 MT it makes both Russia and China potentially very similar in market sizes.

As stated in the introduction Brazil recently had 78 meat establishments approved for China comprising of 26 pork plants, 22 beef plants and 30 poultry plants – this has been viewed as a means to secure pork and beef supplies for China due to the trade war with the US – the speed of these approvals reflects the deepening concerns within China on supply risk.

Brazil’s truckers strike which impacted the country back in May this year saw the cost of transport rise within Brazil by more than 30% – with the largest impact being felt by grain producers – this strike is now being contested in court and could be overturned in 2019.

Brazil’s access back into the US market was discussed and the belief is that Q1 of 2019 might see new developments in re-instating this trade – sources within the US are not so confident believing that any developments may need to wait until after the next US election.

It should be noted that Brazil’s cattle herd expanded between 2013 to 2015 to 215 million and this expansion is expected to continue in 2019 – maintaining itself as the second largest cattle herd in the world behind India – this expansion could see beef exports from Brazil contract in 2019/20 as more females are retained for breeding and fewer animals for slaughter.

Argentina – The US only recently announcing Argentina’s access into the US of 20,000 mt per annum – it has been 20 years since Argentina last shipped beef to the US and this stopped due to foot and mouth disease. Since then Argentina has vaccinated the entire herd against foot and mouth disease and in recent times the USDA has audited Argentina’s inspection system for beef slaughter an further processing and found that it meets US standards – cattle slaughtered on or after November 27th will be given access to the US.

The Argentina Government in 2005 introduced restrictions on beef exports which were designed to keep domestic beef prices stable during this period as a result grazing land moved across into grain production as this became more commercial and in late 2015 (post the election) export taxes were removed from agricultural products and this has seen a steady improvement in export volume with 209,000 MT shipped in 2017 – the expectation is that Argentina’s beef production will increase at a slow and steady pace.

Uruguay – China is Uruguays largest export market taking last year 160,000 MT and in many ways has similar traits to Australia with a national ID system for cattle and they maintain high sanitary standards which has seen them have ongoing access to the US market for many years. Last week Japan and Uruguay agreed to have bi-lateral trade on beef between the two countries, this would be the first time Uruguayan beef has been in Japan since 2000 when an outbreak of foot and mouth disease stopped trade.

Some concerns exist politically within Uruguay regarding the inability of meat processors to terminate workers contracts – this law has placed some real concerns on cost structures and maintaining processing efficiencies and for that reason might see the volume of Uruguay exports remain subdued for some time.

3/ Chinese analysts view – China drives global demand on direct imports as the grey trade starts to be a headache – an estimated 25,000 loads sit idle.

It has been estimated that 25,000 containers (40 footers) are sitting idle in Vietnam or Hong Kong as Chinese authorities crack down on the illegal smuggling trade that exists between Vietnam, Hong Kong and China known as the grey trade – it is estimated that 8,000 containers are of beef products and the balance 17,000 containers comprise of pork, chicken, seafood and offal items.

Some key points to note from this lack of trade:

- The 8,000 containers of beef are estimated to be close to 220,000 MT of beef items or 3 months of regular imports.

- The lack of movement of the 25,000 loads has seen serious cash flow problems as many importers sit and wait for potential China access.

- The cost of smuggling in the last 12 months has risen from $1200 USD/MT to $2900 USD/MT which now puts the total cost at $78,300 per load to smuggle which is likely to exceed the 30% deposit that many importers pay for the product before arrival – in other words for certain importers it is potentially cheaper to walk away from their 30% deposit and leave the shipper to deal with the mess of reselling – its an expensive headache.

- India is a significant shipper into China via Vietnam and this slow down in the grey trade has seen buffalo production within India slow down as almost 50% of India’s slaughtered buffalo goes to China via Vietnam.

When reviewing exports into Vietnam and Hong Kong and direct shipments – in recent months the shipments into the grey channel have fallen away dramatically (due to the problems outlined) and direct China beef imports picked up in July – it should be noted that these export figures below do not include Uruguay, NZ, Argentina and EU beef products but give a good guide on the export trend.

Has Korea become the new grey trade into China?

There is speculation that China pork imports have being occurring via South Korea with a new potential grey trade developing – this is in part based on the extraordinary pork imports going into South Korea in recent months with pork imports for October up 43% on the same month last year and up 16% year to date. This is in addition to a South Korean hog slaughter of 1.687 million head in October which is 29% higher than the same month last year – as expected Korean wholesale and retail pork prices have fallen by 20% and 6% respectively – but interestingly, the volume of pork imports is not getting any less with USDA export weekly sales showing US pork export forward sales into Korea surging in October and November.

Two schools of thought why there are huge South Korean pork imports and high Korean domestic hog kills – firstly, South Korea is stock piling pork in fear of getting African Swine Fever in their own pig population – these fears are well founded based on the closeness of China’s Liaoning province which lies only 480 km from South Korea and has had the most outbreaks of all provinces in China with 15 ASF cases so far. Liaoning province borders North Korea which in turn borders South Korea – the porous borders of North Korea is the underlining concern and is seen as no defence against ASF.

The second theory is that with all the issues of the current grey trade through Vietnam and Hong Kong – South Korea (via North Korea) has become the next ‘port of entry’ for the grey trade and with $2900 USD/MT being the price to do so there are strong incentives for this to occur. The high South Korean pork imports and high domestic hog kills are resulting in large pork volumes moving across the two borders (South & North Korea) into China – there has been lots of anecdotal evidence that this is occurring from various trade participants but it is at this stage a theory and yet to be 100% confirmed.

The October China beef import makeup was as follows:

- Brazil 38%,

- Argentina 25% ,

- Australia 14%,

- Uruguay 13%,

- New Zealand 4%,

- Canada 1%

- and Other at 5%

What is important to note is that the slowing down of the grey trade is resulting in higher imported beef prices direct into China due to less cheaper competition and this in turn is likely to have influenced domestic beef prices – the same situation is occurring with imported pork and need for more and more direct exports which in turn has led to higher imported pork prices – in recent weeks the graphs highlight below increasing price of China pork carcasses both nationally and regionally.

4/ Australia’s drought worsens as it moves towards a new cattle price cycle beginning

Drought conditions in Australia still remain bleak in terms of the national female kill which today sits at just above 50% – when comparing to previous droughts Australia’s current female kill is above where the last three droughts were at this time of year – meaning conditions are still dry and herd liquidation is still very occurring at a significant rate.

When looking at previous droughts and intensity of kills to liquidation I am still of the opinion that a 5.5-6% fall is still a real possibility if dry conditions prevail which would take the herd to below 27 million head mid next year and a further fall in 2020 to 26.5 M head even with rain later this year (should this occur) due to a drop in fertility rates and a diminishing herd size.

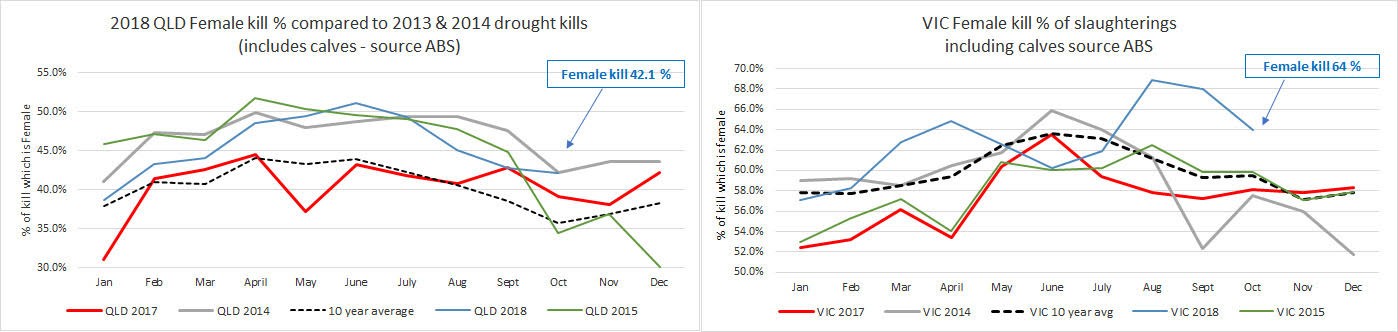

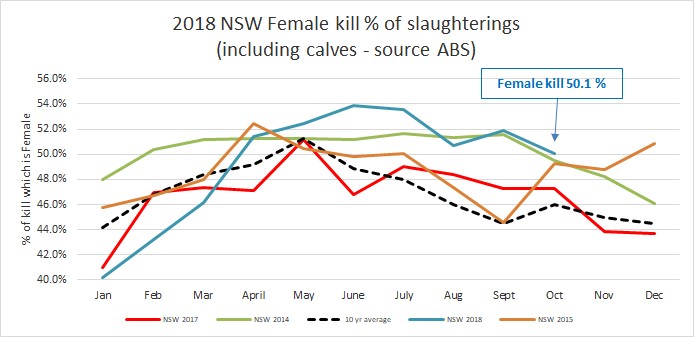

The intensity of the drought seems to have shifted from the northern part of Australia to the south as Victoria’s female kill rate remain very high at 64% and QLD female kill has fallen to 42.1 % – this is not unusual during droughts for the intensity of the female cull to fall away in Q4 based on seasonal supply trends and it also reflects the better rains see in QLD during October – but it is unusual to see the female kill in Victoria be this high at this time of year (dairy and beef female culling is both occurring)

Its important to note that September was Australia’s driest September on record (and August was as dry as 2013 – the last drought) and in contrast areas of southeast Australia (excluding Tasmania) experienced their coldest September nights on record, in particular eastern South Australia, northern Victoria and southern NSW – I think it was this combination of cold nights and dryness that saw pasture growing conditions suffer in Victoria and a spike in female kills resulted in both August and September.

It is the recent dry intensity in NSW and VIC that has maintained this drought as one of the more severe droughts we have seen in recent history.

In certain areas of NSW and QLD in October they received their wettest October day on record or their highest October rainfall on record with thunderstorms producing much of this rainfall and severe storms occurring that lead to significant damage in SE QLD – the female kill figures below reflect this as pastures improved in certain areas. November started and ended in extreme heat but the better rainfall conditions continued through November though it should be noted that at some weather stations experienced record temperatures for both November and annually with some temperatures 6 C higher than previous records and other regions experiencing record runs of consecutive hot days.

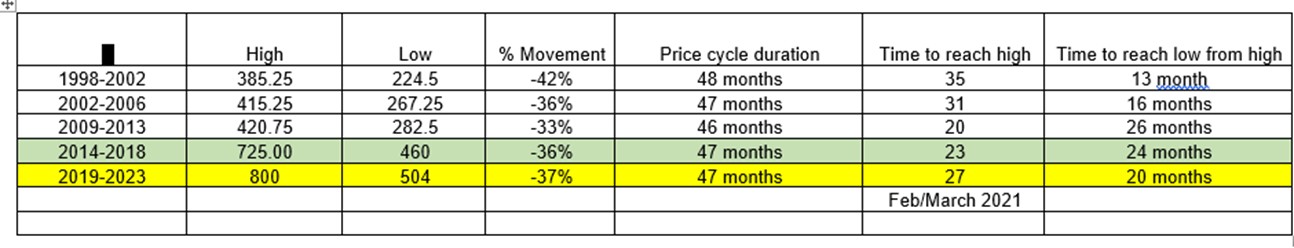

New Australian cattle cycle is getting closer

In short, the real damage to the Australian herd was in August and September this year with VIC and NSW bearing the brunt of poor pasture growth which saw ongoing heavy liquidation which as stated earlier likely to see a 5.5-6% fall in the herd by June 2019 should the dry continue. It is the depletion in the cattle herd and the commencement of a new Australian cattle price cycle that to me is the next critical stage for Australian cattle producers – there is the need for rain to sustain the cattle price cycle and for genuine rebuilding to commence again but when it does occur – I am of the opinion there will be an improvement in prices that will exceed the last price cycle.

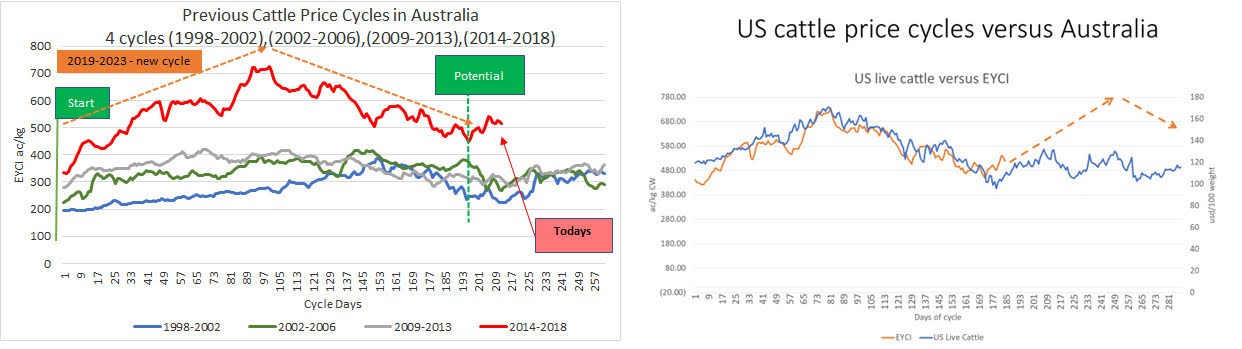

Should the previous cycles be any guide then like 1998-2002 & 2002-2006 I think back to back cycles are real possibility with the next cycle being 2019-2023 (after 2014-2018 cycle) – this I believe will see a high in the EYCI of greater than 800 ac/kg (previous high was 725 ac/kg in Oct 2016) and is likely to occur in Q1 of 2021 (this view is based on the drought breaking in mid to late 2019)

The following is potentially how this new price cycle might look compared to previous cycles – it should be noted that after June 2019 the similarity with the US cattle price cycle from 2 years ago I believe will end and Australia’s cycle will continue in an upward direction but the US cycle has stalled as they have continued to rebuild in the last 2 years albeit today at a snails pace whereas Australia’s rebuild stage is about to commence when the drought finishes.

5/ Conclusion

The most crucial aspect of 2018 and 2019 has and will be the role of China and the potential impact of African Swine Fever on demand across all proteins including pork, beef, sheepmeat and chicken. The emergence of Russia as another key global buyer of protein is likely to be price supportive, particularly on beef and could see Brazil in a unique position of having two new strong markets vying for the same beef in 2019 and 2020 along with there traditional markets.

Concern about US record production in beef and pork that could see prices been dampened will be more than offset by strong exports through either direct exports to China if and when the trade war issues are resolved or by displacement – whereby the US beef exports fill other ‘market holes’ as other major exporters meet China’s needs. A short term concern is the large volume of grey trade pork, beef, chicken and seafood that exists in Hong Kong and Vietnam (estimated 25,000 loads or 675,000 tonnes) – this meat is unlikely to enter China and is therefore likely to be diverted to secondary markets which in turn could see a short term pressure on prices. I think from an Australian and New Zealand point of view this will have minimal impact on beef exports and prices as diversion into Japan, Korea, US and China is unlikely which are our major markets.

The other key factor that will offset 2019 increase in US production is the likely fall in Australian exports due to drought and the expected fall in Brazilian beef exports due to a heightened herd rebuilding stage which will see females retained – the net affect is that the increase in US production, as stated earlier, will be more than offset by Australia and Brazil’s expected production declines.

Given the expected protein shortage within China and potentially across Asia due to African Swine Fever spreading and the strong global demand for beef, sheepmeat and chicken the prospects of strong global meat prices for 2019 – 2021 is a real possibility.

I would like to thank the four analysts that participated in the discussions outlined in this paper these being; Lygia Pimmental from Agrifatto in Brazil, Gerrard Liu from Meat International Group in China, Kevin Bost from Procurement Strategies Incorporated and Brett Stuart from Global Agritrends both based in the US.

Any feedback is always appreciated.

Regards

Simon

Notice:

This email may contain confidential information. If you are not the intended recipient, please immediately notify us at by replying to the sender, and then destroy all copies of this email.

No advice: Unless specifically stated, nothing contained in this communication constitutes investment, legal, tax, financial or other advice and it should not be relied on in making an investment or trading decision (e.g. to acquire, hold or dispose of a financial product). Any advice provided has been provided for general information purposes only and may be based on incomplete or inaccurate information and did not take account of your objectives, financial situation or needs.

I make no recommendations as to the merits of any financial product or service referred to in this newsletter and/or attachments or on its websites.

This email (and any attachment) is for the exclusive use of the addressee and may contain information that is privileged, confidential or protected by copyrights. If you are not the addressee or the person responsible for delivering this email to the addressee, you must not disclose, distribute, print or copy this email and the contents must be kept strictly confidential.

I trust you found this report of interest and we will endeavour to find other interesting articles throughout the year.

Regards,

Richard Brosnan

Latest News

The way of more flesh Global meat-eating is on the rise, bringing surprising benefits – By The Economist

As Africans get richer, they will eat more meat and live longer, healthier lives International May 4th 2019 edition By THE ECONOMIST Magazine available online. BEIJING, DAKAR AND MUMBAI Things were different 28 years ago, when Zhou Xueyu and her husband moved from the coastal province of Shandong to Beijing … Read more